I have then added 35 to 45 Items and Sub-Items that I checked the box of their properties so that it will provide the option to use the Expense Account called Construction in Progress and the Income Account of Construction Income. Then I have Construction Income that is an Income account. So far from my 'research' I have came to what I thought was a good solution but want to run it by you guys and make sure it's not going to bite me in the ass.īasically I have a Construction in Progress which is an Other Current Asset account. I always did my own taxes before this LLC. This is my first time trying to do this as an LLC instead of just a side gig. My CPA is hammering me into using quick books but I can't fault them because it will make my CPA bill cheaper come quarterly or year end. In quick books it's like adding a fifth dimension.

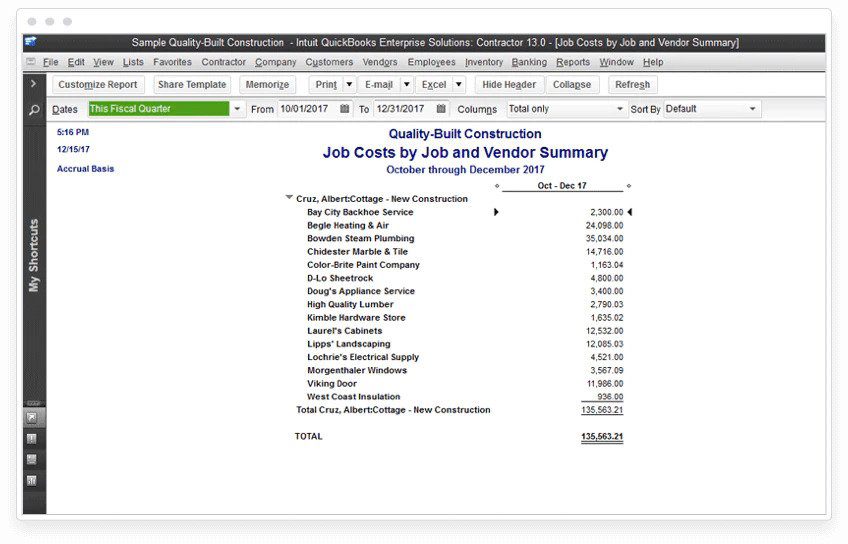

Say one month I am doing a remodel, so I need to record every cost for that project so when I get paid I can apply the paid amount against those expenses and show what profit I need to pay tax on. I need to have each Job/Project accrue its own list of expenses. candy store with candy inventory selling to random daily customers vs myself, construction guy building various projects) I have watched several YouTube videos on recording expenses in quickbooks but they all have a variance either because of dated video, or from a different type of business (i.e.

0 kommentar(er)

0 kommentar(er)